Bookkeeping

Book Balance vs Bank Balance: A Guide to Financial Reconciliation

At the end of an accounting period, typically at the end of a month or year, it is necessary to find the balance on each ledger account in order that a trial balance can be extracted as part of the accounting cycle. The process is referred to as ‘balancing off accounts’ or balancing the ledger. The previous entries are standard to ensure that the bank records are matching to the financial records.

How much will you need each month during retirement?

In huge companies with full-time accountants, there’s always someone checking to make sure every number checks out, and that the books match reality. In a small business, that responsibility usually falls to the owner (or a bookkeeper, if you hire one. If you don’t have a bookkeeper, check out Bench). For the first time in history, Algeria has not just an Olympic medalist in gymnastics — but a gold medalist.

What is your current financial priority?

- Checks that have been written and sent out but have yet to clear through the banking system.

- This process helps you monitor all of the cash inflows and outflows in your bank account.

- The account balance at the start of an accounting period is referred to as the beginning balance or the opening balance.

- The Nike Book 1 arrived in patriotic fashion with a predominantly navy upper on the shoe’s leather and canvas twill mixture.

- The term is most commonly applied to the balance in a firm’s checking account at the end of an accounting period.

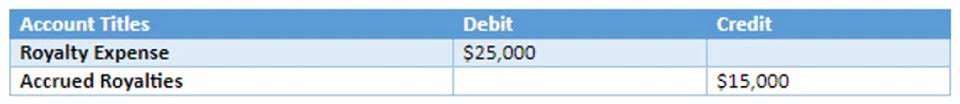

- When you record the reconciliation, you only record the change to the balance in your books.

To set up a budget, gather your financial data, such as income statements, balance sheets, and cash flow statements. This will give you a clear picture of your business’s past financial performance and help you make realistic projections for the future. The accrual accounting method records financial transactions when they occur rather than when cash exchanges hands.

Business Manuals

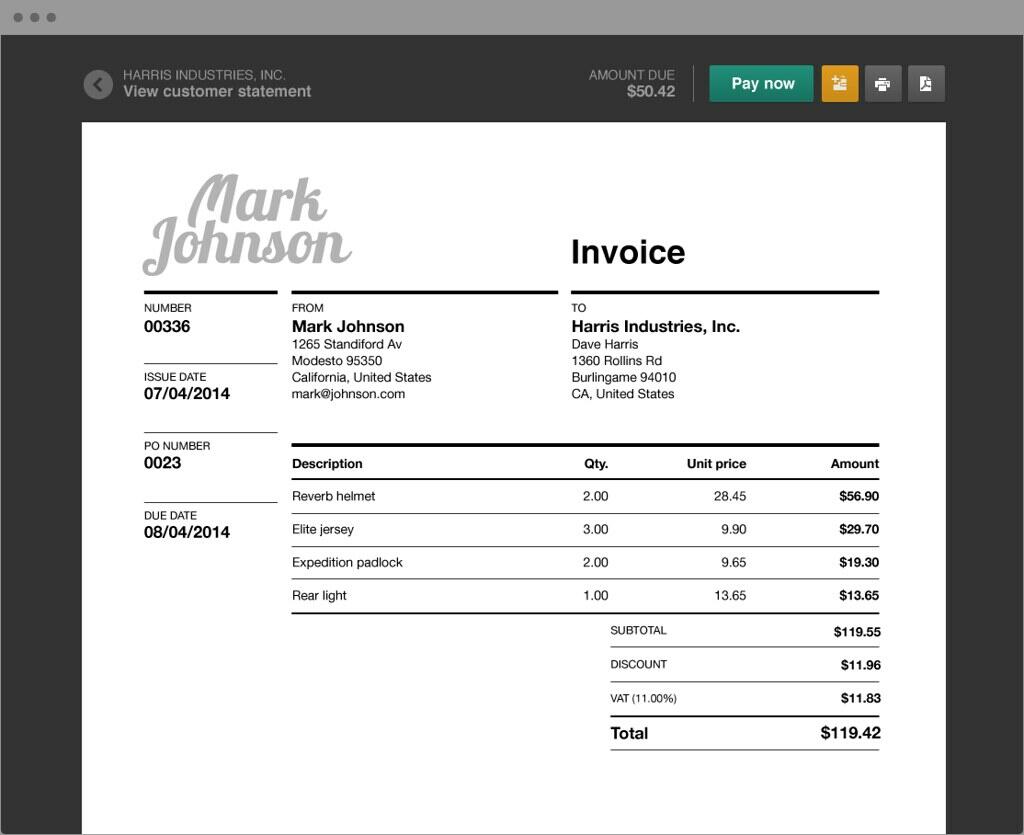

Just divide the market price per share by the book value per share. If the market price for a share is higher than the BVPS, then the stock may be seen bank balance vs book balance as overvalued. The following image shows Coca-Cola’s “Equity Attributable to Shareowners” line at the bottom of its Shareowners’ Equity section.

Explanation of Bank Balance

In fact, when a cash book is maintained separately, there is no need to keep a cash account in the ledger. For all purposes, a cash book is treated as a cash account (i.e., a part of the ledger). In contrast to the permanent account, the balance on a temporary account does not continue into the next accounting period. The temporary account is closed for the period by transferring the balance to the income statement.

If your business is still small, you may opt for cash-basis accounting. If you carry inventory or have accounts payable and accounts receivable, you’ll likely use accrual accounting. The first step you’ll need is a business bank account, which allows you to keep your personal and business expenses separate. Bank accounts allow businesses to safely store their money and make transactions easily. There are several types of business bank accounts, each with its own purpose and benefits. An accounting ledger is a book or system you use for recording and classifying financial transactions.